Take Control Of Your Retirement Income In Just 4 Steps

Backed by cutting-edge financial research, our tool puts advanced statistical methodology at your fingertips, guiding you through a proven strategy that maximizes your retirement security while keeping it simple enough for anyone to follow.

Step 1: Create Your Free Account

Create a free account instantly

Register with your email address, or Google.

No fees, no credit cards.

Your personal information is secure and never shared with third parties.

Step 2: Describe Your Situation

Tell Us About Your Household

Start by entering basic information for you and your spouse. This helps us create personalized calculations that reflect your unique household situation.

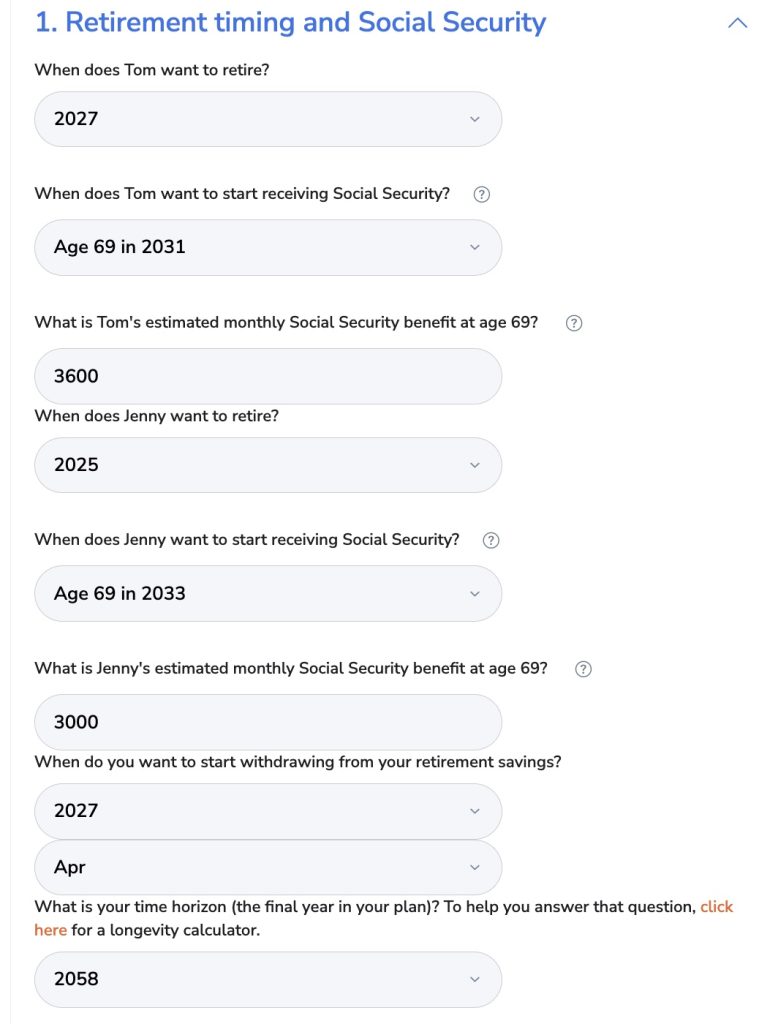

Set Your Timeline

Next, establish when you'd like to retire and start drawing from your retirement savings. You'll also choose when to begin Social Security benefits and enter your estimated monthly amount, which you can find on your statement from the Social Security Administration

One of the most important decisions is determining your planning horizon—how long your money needs to last. Our calculator uses actuarial data to help you decide.

Add Your Financial Picture

Then list any other income sources you expect in retirement, such as pensions, part-time work, or rental income. Enter details about your investment accounts, including your 401(k), IRA, Roth, and taxable accounts with their current balances.

Finally, choose your income target approach. You can select a fixed amount that maintains the same spending power every year, follow a typical lifecycle pattern with higher spending early in retirement that decreases in middle years and increases again for healthcare needs, or create a custom plan with different targets for different periods.

Step 3: Get Your Personalized Income Plan

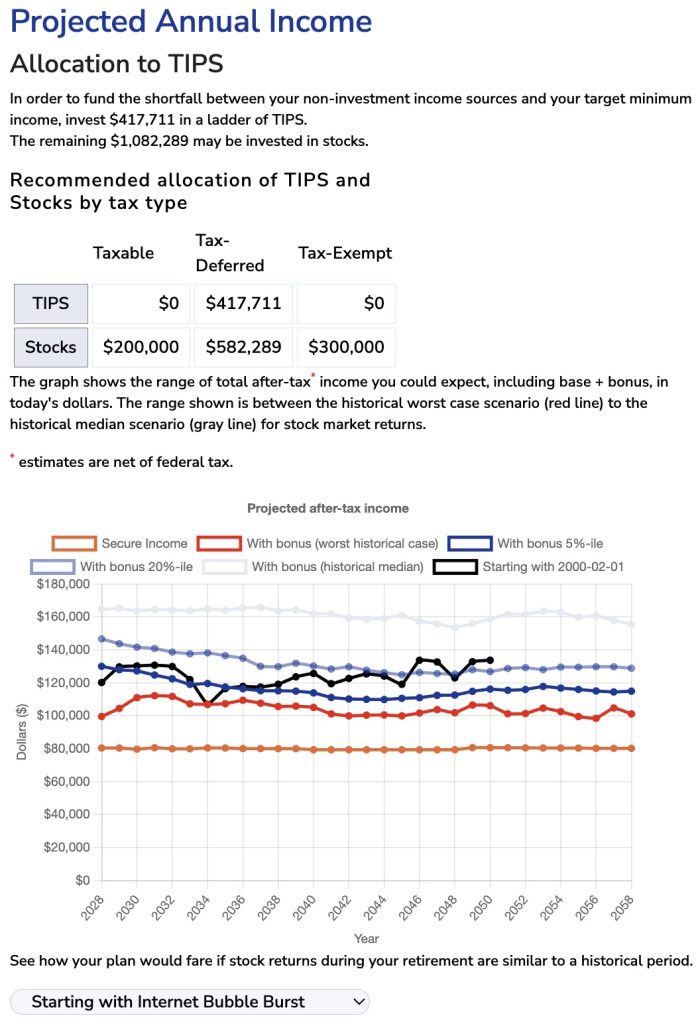

Your Secure Base Income

Think of this as your paycheck in retirement. We’ll show you how to build a rock-solid base income throughout your retirement using TIPS, Social Security and other sources.

Your Variable Potential Income

Think of this as your annual bonus. We’ll estimate your potential additional income from stock market investments. In a good market you’ll get a bigger bonus. In a softer market your bonus will be smaller. But you’ll get a bonus every year. Learn what you have available to invest for variable potential income and understand the range of outcomes based on historical markets, good and bad. Test how your strategy would have performed under different historical conditions, including major market downturns like 1929, the dot-com crash, or the 2008 financial crisis.

Scenario Testing

You can test different “what-if”s. See the potential impacts of decisions like delaying retirement, Social Security timing, and adjusting your Secure Base Income up or down, to optimize your plan for what matters most to you.

Step 4: Start Spending Confidently

Implement Your Action Plan

Once you've reviewed and refined your scenario, you'll receive detailed implementation suggestions that include specific TIPS purchases with exact bond issues and quantities, account optimization showing which investments to place in which accounts, and a clear timeline for executing your strategy.

Monitor and Adjust

Your retirement plan isn't set-and-forget. You can save multiple scenarios to compare different approaches, update your information regularly as your situation changes, and refine your assumptions as you get closer to retirement or as market conditions evolve.

Stay On Track

Life changes and so will your plan. Come back as often as you need to revisit and revise using update inflation, market values and tax rates.